Valuatum Credit Risk Analysis Software

|

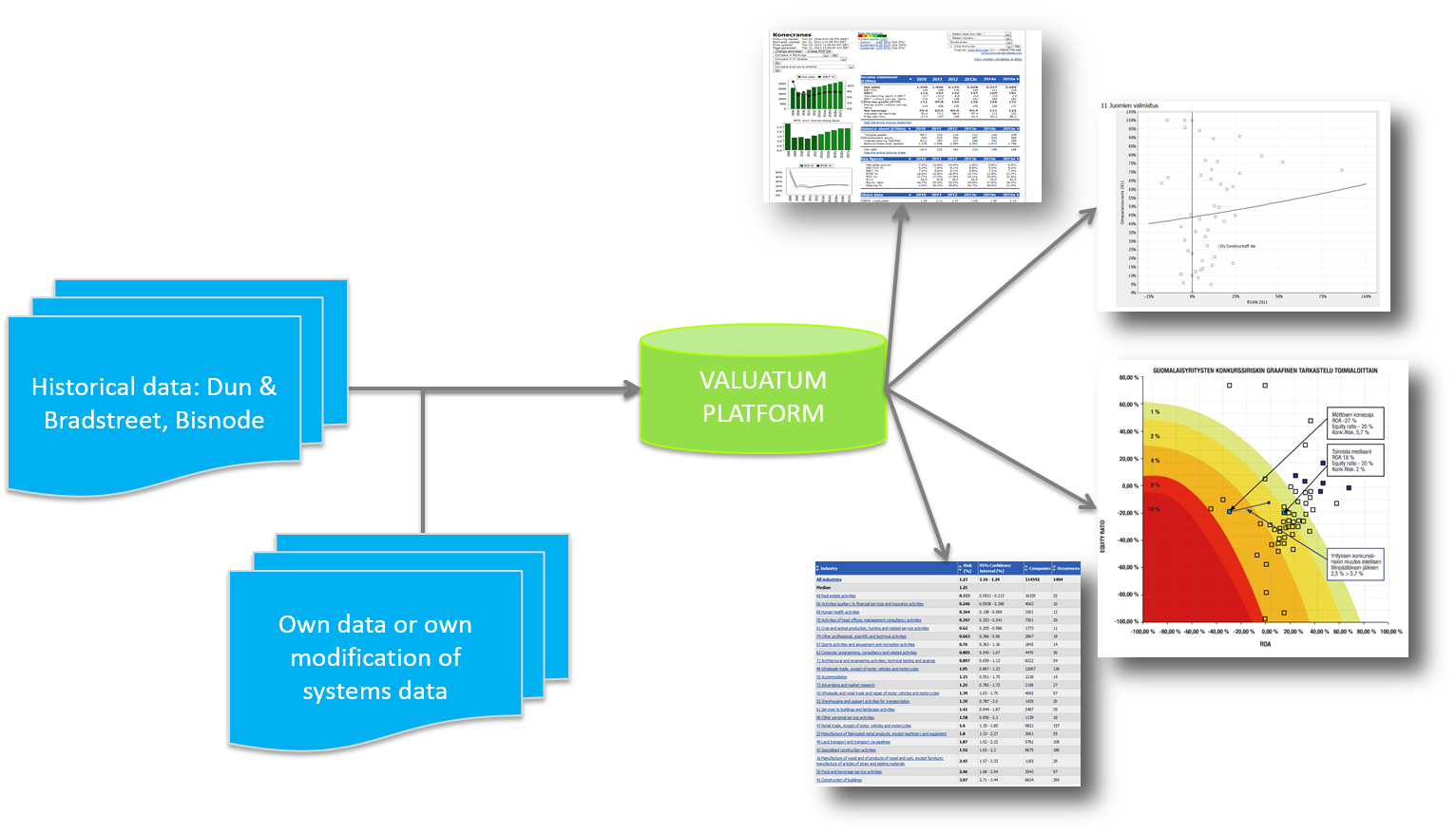

Valuatum Credit Risk solution is a cost efficient financial statement analysis tool to standardize the credit research and rating processes of listed and non-listed companies. Our platform supports both fully automatized and semi-automatized credit risk analysis.

|

Key Features of our Credit Risk Solution

Company Views - overview on the financial position of a company

|

|

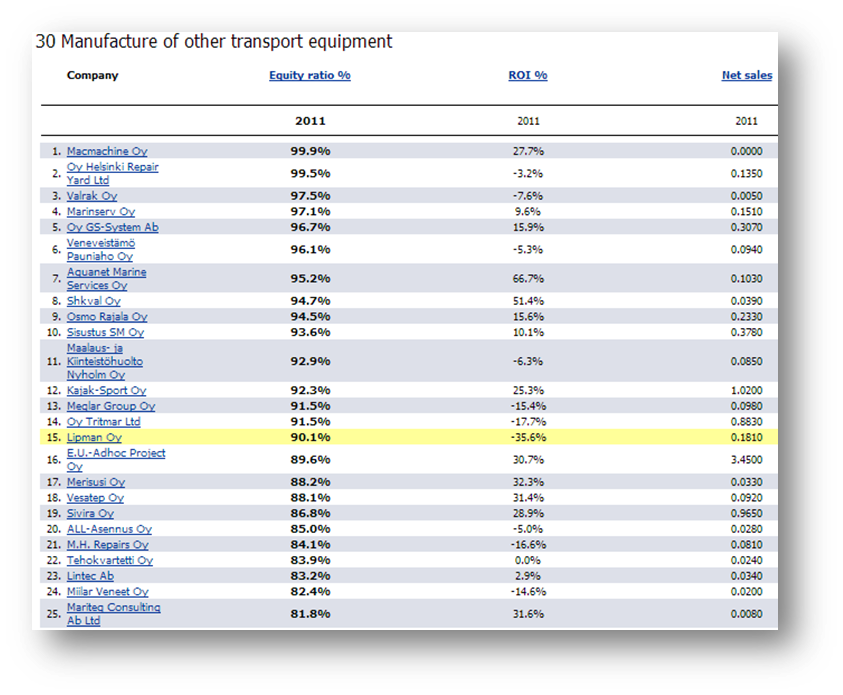

Comparisons - tools for peer group analysis

|

|

|

|

|

Default and bankruptcy risk modeling

|

|