Estimating EBITDA instead of EBIT

Normally estimating in the Valuatum model is based on parameter EBIT. For some industries (e.g. telecommunications) it’s typical to report EBITDA figures for divisions and therefore it’s natural to use EBITDA in divisional estimates instead of EBIT.

Below there are instructions on how to use EBITDA in excel-model (Note: This feature exists only on Empty model versions from 561):

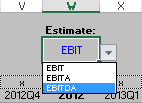

Step 1. Change the estimate parameter to EBITDA in I-divq –sheet Cell W2.

It’s also possible to use EBITA as estimate parameter.

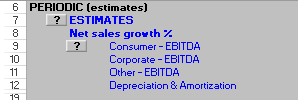

Step 2. Insert divisions In I-divq –sheet cells E9:E18

You can type EBITDA after the division name to avoid misunderstandings, if the figure is shown under EBIT somewhere in the system (e.g. template). After naming the company’s divisions, insert “Depreciation & Amortization” as a last division.

Step 3. Use EBITDA in estimates and insert whole group’s D&A for the last division

After inputting whole group’s depreciation & amortization for the last division (negative value), the divisions total equals to EBIT, even though you use EBITDA figures for divisions.

After these 3 steps you can estimate using EBITDA figures, and everything else in the model works exactly like before. Notice that depreciations & amortizations should also be inserted in the income statement (Rows 134 – 136 for estimates and rows 194 – 196 for actualized years).