|

Forum message title is informative and describes the main point in the analysis. More detailed summary is listed in bullets at the beginning: busy readers can read only this section and decide whether the document is worth reading.

The Ready-made graphs are extremely usefull and make the document more interesting to read. You may also build your tables and pictures.

The first section describes the main operations and strategy of the company. Focus on issues like market position, competitors and competitive advantages. It is not necessary introduce basic company background, the company description information should be filled in the Background section.

In this case, the analyst focuses on the most interesting and relevant things in the target company: foreign growth opportunities. The risks and opportunities are discussed.

Investors are always interested if target company has made some major acquisitions or changes in its operations. Issues like changes in financial position, synergies, possible one-off charges, accounting distortions, competitive issues and overall rationality of the acquisition should be discussed. Remember to adjust your model for the changes.

If possible, estimates should be compared with consensus and management guidance. If estimates are different from the two, the reasons should be justified clearly.

These kind of issues are very exceptional: the analysts expects substantial impairments that investors should take into account. These issues may be presented if reasons are justified.

Recommendation and target price (if given) are concluded clearly. To sum up, the whole document should be drawn up to support the recommendation.

Message: This is an example of initial forum message. It provides examples of what kind of things can be taken into account when writing forum comments. Please select back in your browser to return to the instructions.

| Demo Analyst |

| Jan 8, 2009 8:34 PM |

| Deteriorating market conditions put Stockmann at high risk: proof of profitable growth needed |

Following

starts with hold -recommendation: the Russian growth opportunities are

offset by the weak economic prospects: proof of profitable growth

needed

· Stockmann Group: cash generating established operations in

Finland, Sweden and Norway, growth seeking strategy in Russia and

Eastern Europe

· Lindex acquisition in 2007: debt-laden balance sheet due to

overpriced acquisition and current amount of goodwill exceeding equity

book value

· Introducing the Lindex concept in Russia has been slow so far

· Stockmann likely to take substantial impairment charges on goodwill reflecting the deteriorating market conditions

· Consumer demand in Russia has remain strong in spite of the economic turbulence until now

· Competitors postpone their investments in Russia: Stockmann might even be able to capitalise on the crisis

· Consensus has remained optimistic: Q4 performance likely to fall short of expectations

· Expected profit warning on Jan 8, several factors put pressure on margins

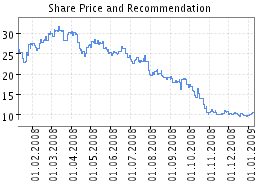

· Share price moderately valued: recommendation hold, target price 10.00 euros

Strategy introduced

The group has its established operations in Finland, Sweden

(Lindex) and Norway (Lindex). Each area shows good profitability with

solid cash flows, but the growth potential is very limited. The

department store division has a strong market position and customer

loyalty in Finland: 65% of sales from loyal customers, 1 million loyal

customers in Finland.

The non-core mail order business Hobby Hall shows weak

profitability and declining sales, a unit likely to be divested in

future.

The Group seeks growth from the emerging markets of Eastern Europe

and Russia. The key of the growth strategy is to acquire strong

position in new shopping malls by having a department store, Seppälä

and Lindex under the same location. The successful customer loyalty

program is carried out also in the foreign markets with 0,7 million

loyal customers abroad currently.

Key competitive advantages: established operations, high customer

loyalty, strong profitability in Nordic market, long expertise in

Russian market (since 1989)

Key growth driver: Russian market

Stockmann has posted increasing sales in Russia in spite of the

financial turbulence, most likely because households in Russia have

little debt and their purchasing power is more dependent on employment.

However, I consider that the risk of collapse in consumer purchasing

power is significant if the Russian real economy follows the plummeting

oil price.

The operating environment in Russia is challenging but not as

difficult for operations categorised strategic by the government. Grey

economy, double invoicing, high import duties and litigations are main

concerns, Russian's WTO membership would make the situation better for

Stockmann.

Three reasons why the Group might be able to capitalise on the financial crisis in Russia:

1) local operators exit the market or face problems financing their

operations 2) unlike its local competitors, Stockmann is likely to be

more trusted by its suppliers, 3) competitors postpone their

investments in the market creating competitive advantage for Stockmann,

this advantage, however, might be offset by the weakening consumer

demand.

Lindex acquisition

Lindex is currently having a strong market position in its existing

markets that maintain a strong cash flow. The main driver for the

acquisition was to establish the Lindex concept in Russia by exploiting

Stockmann's experience in the market. Also, possible cost synergies

with Seppälä exist.

Proof of profitable growth needed

The Group now combined with Lindex is eager to expand in Eastern

Europe, Russia and even in Saudi Arabia. The acquisition that was

carried out at the peak of the cycle was substantially overpriced and

brings Stockmann's into much weaker financial position. In 2007

financial statements, Stockmann said it aims to open 20-25 Lindex

stores in Russia in 2008, so far only one has been opened.

Stockmann likely to take substantial goodwill impairment charge in Q4

Due to the EUR 850.9 million acquisition cost of Lindex, Stockmann

is currently carrying over EUR 800 million of goodwill in its balance

sheet. The debt financed acquisition put Stockmann into a much weaker

financial position (Q3 gearing 130%) and the company is currently

carrying a goodwill higher than its equity book value. In spite the

company has re-arranged its long-term financing (release 19.12.2008), I

am expecting that some of the Lindex goodwill is likely to be impaired

this year.

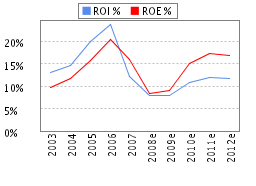

A quick back-of-the-envelope calculation shows this to us: the

recoverable amount (NPV) of Lindex exceeded the carrying amount (EUR

895 million) by EUR 73 million in Dec 31, 2007 impairment testing. The

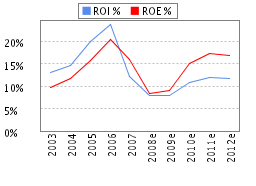

applied discount rate (WACC) was 8.1%. Using Q3 figures, Lindex's

invested capital was EUR 987.4 million and 12 months rolling EBIT was

EUR 53.4 million, which yields a 5.4% ROIC. Since the current and my

estimated ROIC are clearly below the discount rate, the NPV of Lindex

is likely to not meet the current carrying amount in this year's

impairment testing. The probable impairment is not taken into my

estimates.

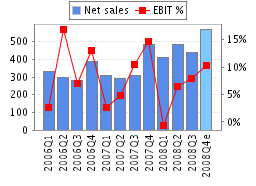

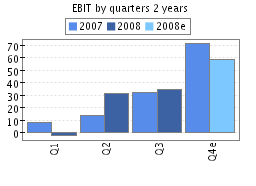

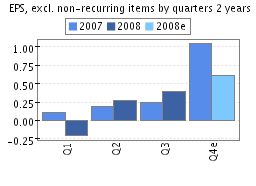

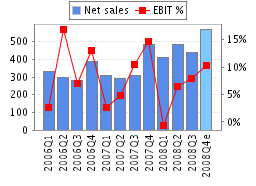

Q4 estimates: consensus looks too optimistic

I expect Stockmann's Q4 sales to decline slightly on y-o-y basis,

if Lindex consolidation is not taken into account. The sales reports

posted during Q4 indicate highest sales decline in department store

(approximately -7%) and Hobby Hall (approximately -10%).

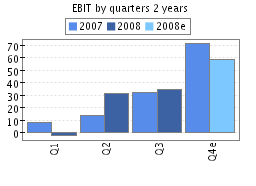

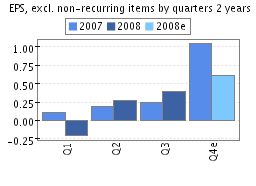

My estimate for Q4 EBIT is EUR 58 million, lower than consensus (77

million) and in line with management outlook (lower than in Q4'07, 71

million) posted in the recent profit warning. I base my pessimistic

expectation on the following factors: 1) December sales report

indicates weaker sales, 2) Slomenskaya department store remains closed

3) devaluation of the rubble affects purchasing power of Russian

customers in both Finland and Russia 4) rapidly weakening consumer

demand in Finland has forced the stores to discount sales earlier than

usual. Also, the weakening sales currencies SEK, NOK put pressure on

margins and the erosion of krona-denominated loans will affect 2008

EPS.

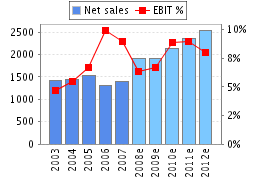

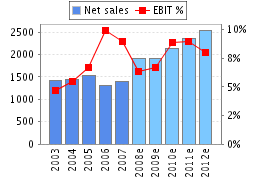

Management has not given outlook for 2009, my EBIT estimate ( EUR

123 million) is below consensus (EUR 147 million). I expect 2009 sales

to increase slightly supported by openings of new stores.

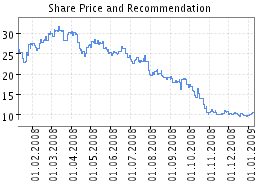

Conclusions

My estimates for 2010-2013 operating margin (8-9%) are clearly

below management target (12%). I remain cautious in the estimates due

to the possibility of a protracted recession in main markets and

failure of the leveraged acquisition-driven growth strategy. If the

targets are achieved, the share would appear to be extremely cheap. The

value of Russian growth opportunities is offset by the high risk for

impairment, rapidly weakening short-term prospects and the risk of

protracted recession. My recommendation is hold, target price at 10.0

euros.

|

| Last edited on Jan 8, 2009 8:34 PM,

1 time(s) in total |

Reply to this message

Return to Forum

|